If you’re planning to buy your first home, saving up for all the costs involved can feel daunting, especially when it comes to the down payment. That might be because you’ve heard you need to save 20% of the home’s price to put down. Well, that isn’t necessarily the case.

Unless specified by your loan type or lender, it’s typically not required to put 20% down. That means you could be closer to your homebuying dream than you realize.

As The Mortgage Reports says:

“Although putting down 20% to avoid mortgage insurance is wise if affordable, it’s a myth that this is always necessary. In fact, most people opt for a much lower down payment.”

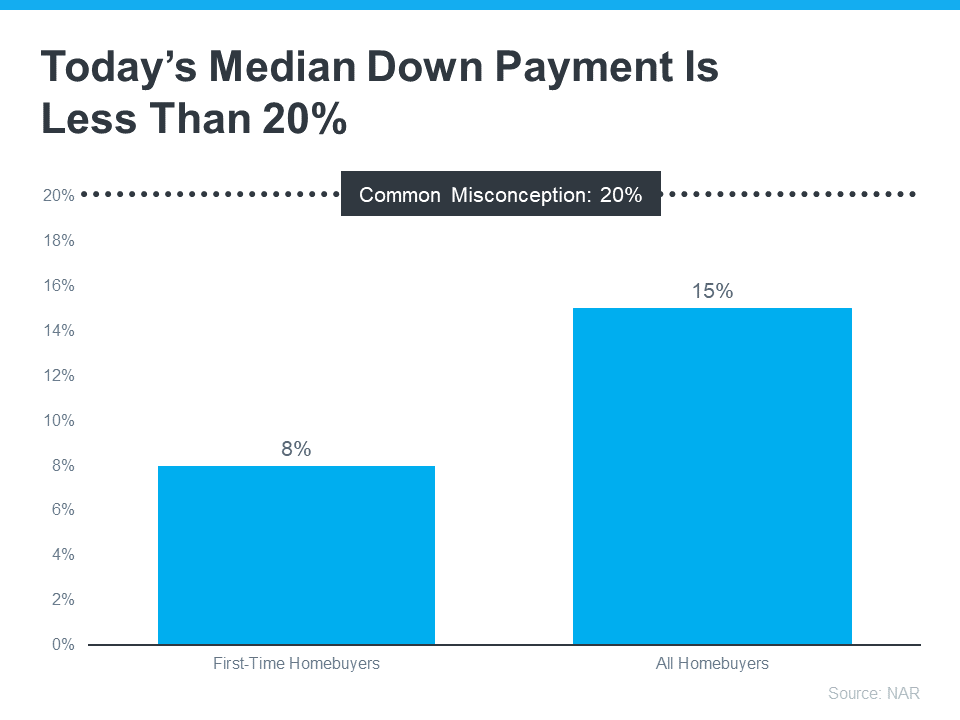

According to the National Association of Realtors (NAR), the median down payment hasn’t been over 20% since 2005. In fact, for all homebuyers today it’s only 15%. And it’s even lower for first-time homebuyers at just 8% (see graph below):

The big takeaway? You may not need to save as much as you originally thought.

Learn About Resources That Can Help You Toward Your Goal

According to Down Payment Resource, there are also over 2,000 homebuyer assistance programs in the U.S., and many of them are intended to help with down payments.

Plus, there are loan options that can help too. For example, FHA loans offer down payments as low as 3.5%, while VA and USDA loans have no down payment requirements for qualified applicants.

With so many resources available to help with your down payment, the best way to find what you qualify for is by consulting with your loan officer or broker. They know about local grants and loan programs that may help you out.

Don’t let the misconception that you have to have 20% saved up hold you back. If you’re ready to become a homeowner, lean on the professionals to find resources that can help you make your dreams a reality. If you put your plans on hold until you’ve saved up 20%, it may actually cost you in the long run. According to U.S. Bank:

“. . . there are plenty of reasons why it might not be possible. For some, waiting to save up 20% for a down payment may “cost” too much time. While you’re saving for your down payment and paying rent, the price of your future home may go up.”

Home prices are expected to keep appreciating over the next 5 years – meaning your future home will likely go up in price the longer you wait. If you’re able to use these resources to buy now, that future price growth will help you build equity, rather than cost you more.

Bottom Line

Keep in mind that you don’t always need a 20% down payment to buy a home. If you’re looking to make a move this year, let’s connect to start the conversation about your homebuying goals.

The Truth About Down Payments

🏠 Planning to buy your first home can be daunting, especially with the common belief that a 20% down payment is required, but that’s…

Strategic Tips for Buying Your First Home

🏡 Navigating the excitement and challenges of buying your first home involves overcoming today’s market hurdles with three key tips to make your dream…

Why So Many People Fall in Love with Homeownership

🏠 Dive into why becoming a homeowner is such a heartfelt journey and why it’s easy to fall in love with owning a home.

Loan options for first-home buyers

🏦 Have you ever heard the term “Silver Tsunami” and wondered what it’s all about? If so, that might be because there’s been lot…

Will a Silver Tsunami Change the 2024 Housing Market?

👩🦳 Have you ever heard the term “Silver Tsunami” and wondered what it’s all about? If so, that might be because there’s been lot…

Experts Project Home Prices Will Increase in 2024

📈 Even though home prices are going up nationally, some people are still worried they might come down. What experts forecast will happen with…

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link